Talk to a PlusLife Expert

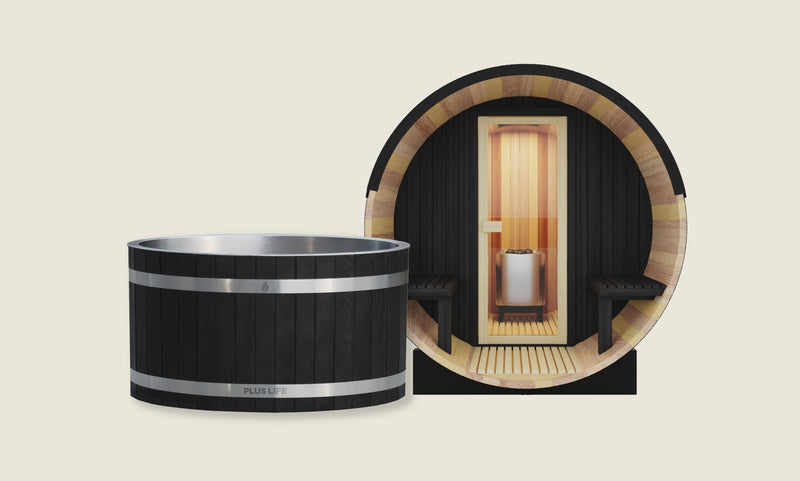

Not sure which sauna or ice bath fits best? Speak with our team to get clarity and confidence before you buy.

Do you have questions about the product?

Text us to Unlock an Exclusive Deal

Talk One-on-One with a Sauna & Ice Bath Expert

Hotline: 0483 961 173 | Mon–Fri 9am–5pmRequest a Call Back

Fill out your details and one of our experts will get in touch.

Would you prefer to choose the time instead?

Book a Call at your convenienceEmail an Expert

Send your questions directly to our team and get tailored advice on the right sauna or ice bath for your needs.